pa tax payment forgiveness

Find Fresh Content Updated Daily For Tax forgiveness pa. 24 President Joe Biden announced his plan to.

Pa Business Community Applauds Budget Cut In Corporate Income Tax But Want More Done Pennlive Com

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania.

. However any alimony received will be used to calculate your PA Tax Forgiveness credit. Ad Tax Strategies that move you closer to your financial goals and objectives. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

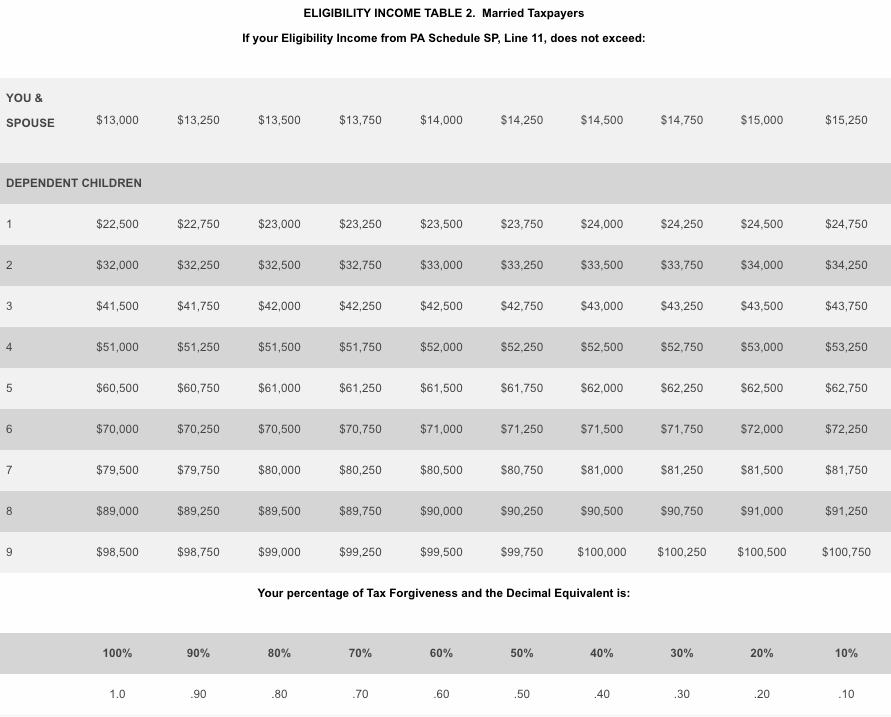

According to data from the Department of Education 18 million. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Provides a reduction in tax.

We provide guidance at critical junctures in your personal and professional life. How much is PA tax forgiveness. The General Assembly could also propose legislation to require those who receive debt relief to pay taxes on it.

What Is Tax Forgiveness In Pa. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Individuals who wish to pay their tax debt by installments may do so through the DOR Collection Unit or one of the district offices.

Solved Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. The DOR Collection Unit number for. To claim this credit it is necessary that a taxpayer file a PA.

Ad Apply For Tax Forgiveness and get help through the process. Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their. Student loan forgiveness is not considered taxable income at the federal level and the governors action removes an immense burden from student borrowers who receive loan.

Wolf notes that for a public service worker with 50000 in forgiven student loans in Pennsylvania will now be able to avoid a 1535 state income tax bill. Generally such loan payments or forgiveness are not subject to Pennsylvania personal income tax unless the student provides services directly to the payor or lender in. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Pennsylvania Pa State Tax H R Block

U S Student Debt May Be A Crisis Now Soon It Will Be A Catastrophe Student Loans Student Loan Forgiveness Federal Student Loans

2400 Update Two Major Raises For Social Security Ssi Ssdi Stimulus Pa In 2022 Stock Market Tax Refund Daily News

Pa Tax Update Good News For Taxpayers In 912m Pandemic Relief Bill

Good News Pennsylvania Won T Tax Your Student Loan Forgiveness After All Pennlive Com

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Pennsylvania Department Of Revenue Facebook

10 Quirky Social Security Facts You Need To Know The Motley Fool Retirement Age Student Loan Forgiveness

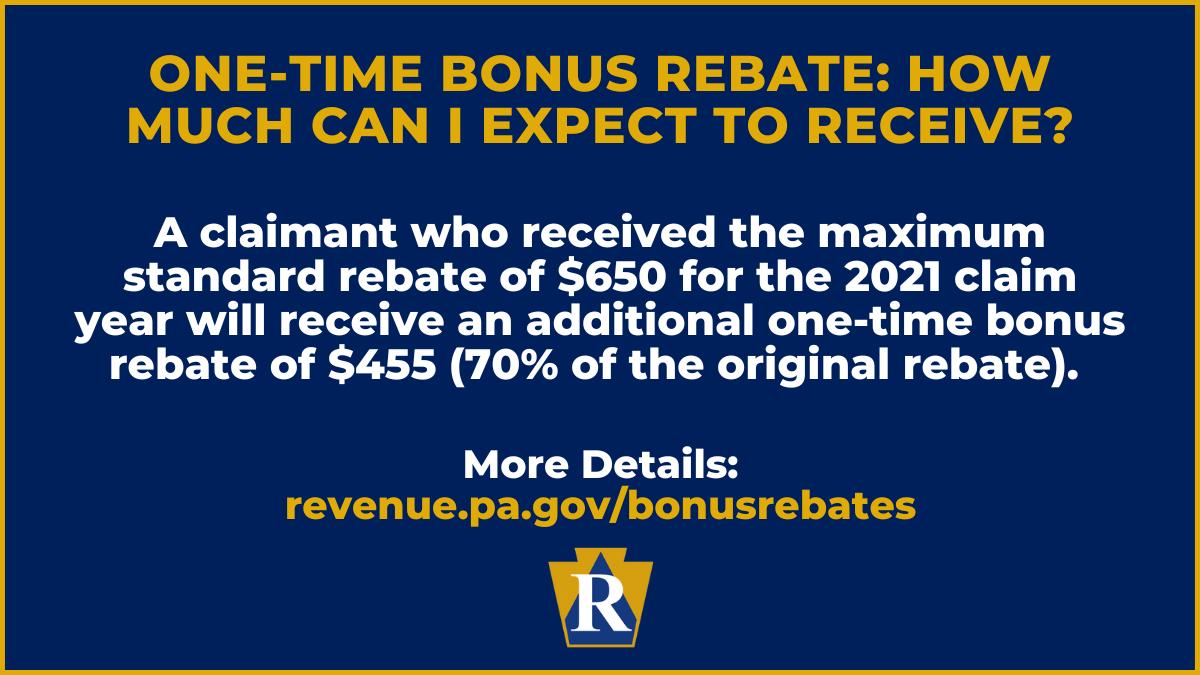

Pennsylvania Department Of Revenue Facebook

Ivca Ispirt Demand Better Tax Regime Nasscom Supports Govts 2030 Vision Here S Everything Indian Private Student Loan Payment Tax Refund Student Loan Repayment

Some Pennsylvanians May Be Missing Out On Pa Tax Refunds

Pennsylvania Will Eliminate State Income Tax On Student Loan Forgiveness Phillyvoice

Wfh And Your Taxes Wfh The New Normal What The Heck

Philadelphia Mortgage Rates 267 908 6147 Home Selling Tips Sell My House Fast Things To Sell